Stellantis is not afraid of Chinese competition in the electric vehicle market. Instead, it aims to compete with the Chinese electric vehicle giants through two new strategic partnerships. The partnership with CATL will enable Stellantis to remain competitive and offer European consumers a viable alternative to Chinese electric cars.

Stellantis relies on CATL for batteries for its future European electric cars.

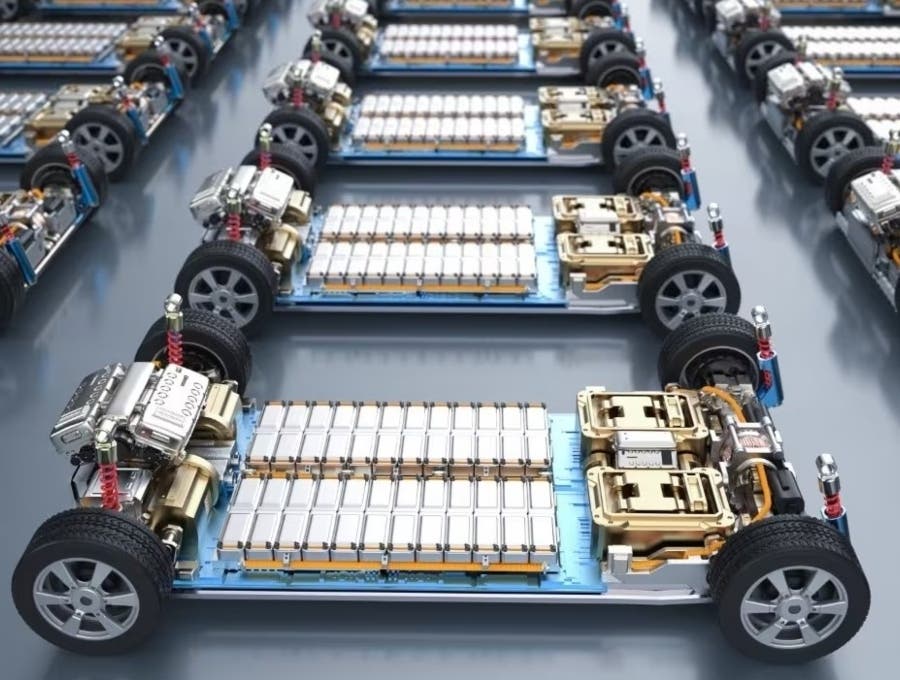

Stellantis automotive group is making a strong reference to Chinese CATL batteries for all future electric cars to be produced in Europe. This is a grand strategy business agreement on the part of Stellantis, with which it wants to achieve the goal of making the group’s electric vehicles more competitive in the market. This would be possible through the use of LFP (lithium iron phosphate) technology in which CATL is a global leader. In fact, the Chinese company is a global leader in the continued research and production of lithium-ion batteries for vehicles, as in the case of Stellantis, but also for energy storage systems.

It should be noted that Stellantis’ partnerships with the Eastern world arise from a context regarding the great competition in the electric vehicle market, especially with Chinese companies operating in the sector. According to Carlos Tavares, CEO of Stellantis, Chinese operators are currently enjoying a very competitive advantage of about 30 percent over the cost of the same cars in the Western world. For this very reason, the automotive group has decided to focus on Chinese technologies and partnerships to remain at the top of the market even as price competitiveness.

Through this new joint venture, Stellantis has also decided to revise its production plans for the batteries. Initially, the automotive group’s idea was to plan to build new plants to manufacture these batteries in both Germany and Italy, but this plan is currently on hold. Now, Stellantis is planning to produce the batteries directly on CATL sites.

LFP batteries certainly stand out for their low production costs, since the process by which they are created does not require rare metals such as cobalt, for example. This detail, underlies the success of Chinese electric vehicles in terms of affordability, as the final costs of the cars are significantly lower.

In addition to the collaboration with CATL, Stellantis has also entered into a commercial agreement with Chinese electric vehicle startup Leapmotor. This new agreement calls for Leapmotor’s electric vehicles to be produced in Stellantis’ European plants. Thereafter, all units would be marketed in nine different countries in Europe starting in September of this year.

Stellantis’ strategy presently, therefore, is to respond to China’s cheap electric car offensive with one of its own. This would exploit exactly the competitive advantages that are offered by the Chinese partners. Stellantis’ low presence in the Chinese market (only 1 percent of new vehicle sales) has made it easy to set up these new partnerships. Strategy based heavily on partnerships with leading Chinese companies. Currently, it is the best option to strengthen Stellantis’ position in the evolving electric vehicle market.