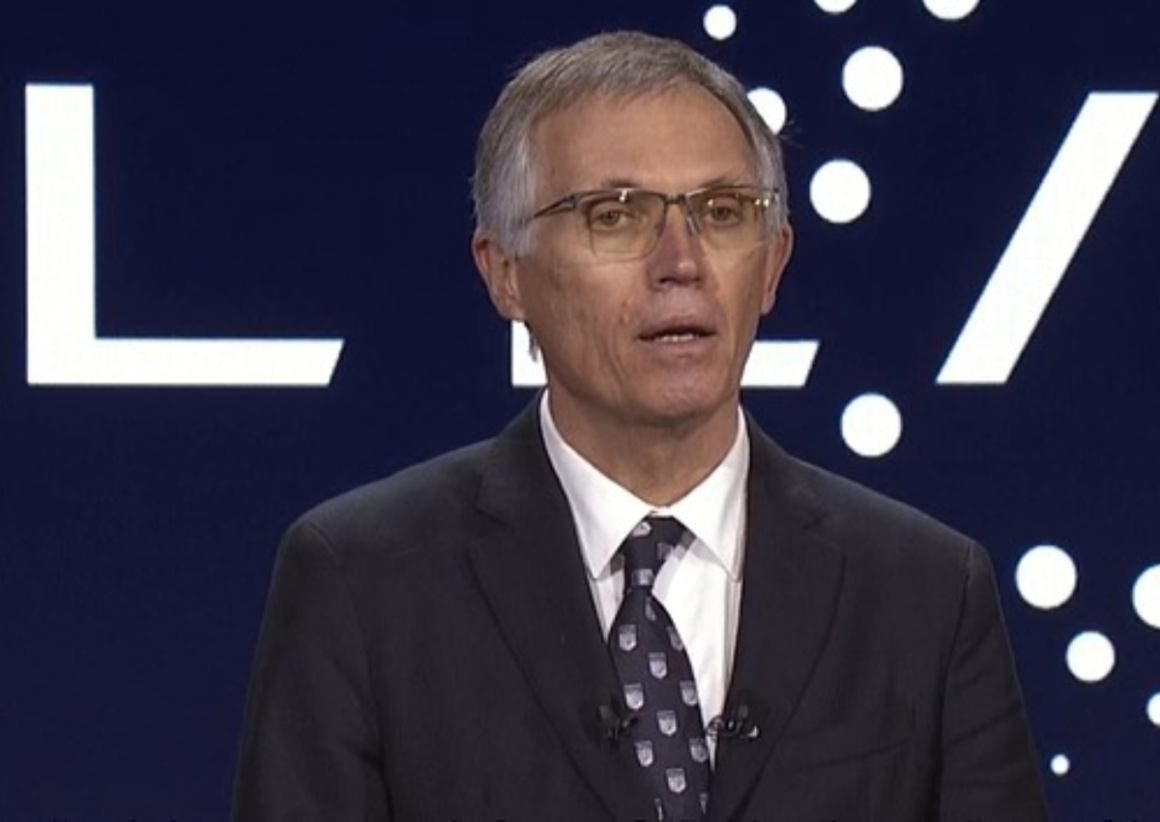

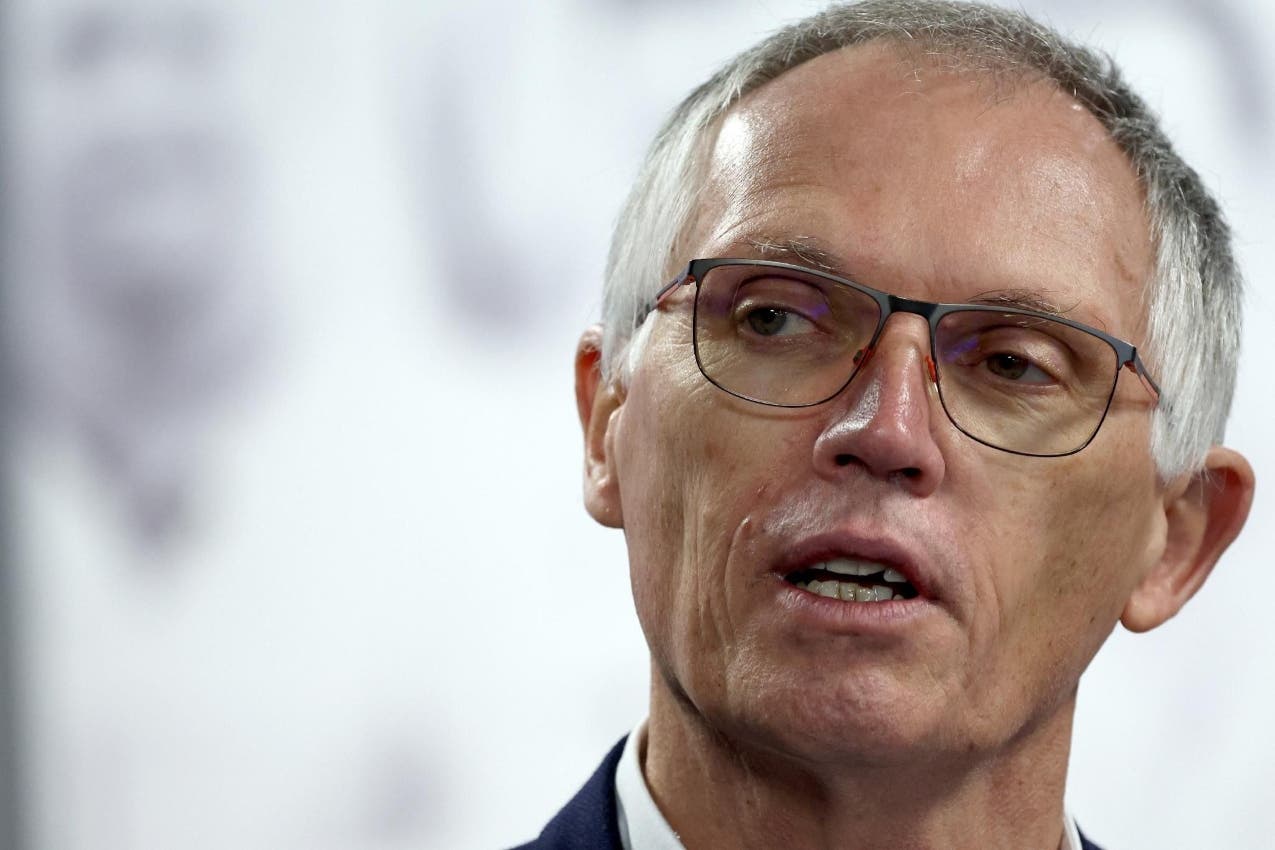

A senior Stellantis executive recently suggested that CEO Carlos Tavares’ resignation might be due to disagreements with the board regarding short-term business strategies and how to manage relationships with external parties, such as dealers, suppliers, unions, and governments. Doug Ostermann, Chief Financial Officer, explained that the differences concerned actions needed to balance short-term objectives with long-term benefits. He also emphasized the need to rebuild trust with stakeholders following the CEO’s resignation.

Stellantis: disagreements over relationships with suppliers, unions, governments, and dealers at the root of Tavares’ departure

“I think there’s a strong desire among the management team today to work on rebuilding trust, and it will take time, but I believe it’s an area we wanted to address quite directly,” said Ostermann, who assumed the CFO role in October during a previous management reshuffle after serving as the company’s Chief Operating Officer in China.

Tavares had long taken a tough approach with external groups like suppliers and dealers, especially when it came to cutting costs. The Portuguese manager was due to retire when his contract expired in early 2026, but ultimately left earlier due to diverging opinions with the board. This week Stellantis outlined a plan to find his replacement in the coming months and appointed a committee led by Chairman John Elkann to manage the company in the meantime.

Problems in the U.S. market, including high inventory levels for Chrysler, Dodge, Jeep, and Ram, have negatively impacted the automaker’s performance this year. However, Ostermann stated that the recovery plan is ahead of schedule. He confirmed updated financial forecasts for 2024, which include an adjusted operating income margin of at least 5.5%, compared to the previous forecast of a double-digit reduction. The company has already exceeded its goal of reducing inventory below 330,000 units by year-end, with approximately 310,000 units at the end of November, thanks to incentives, price adjustments, and production suspensions at various U.S. plants.

“We need to be able to show the industry and investment community what our business is truly capable of,” Ostermann said. “And certainly this year is not representative of that.” The CFO also acknowledged that many of the company’s challenges this year could be attributed to both gaps in its product lineup and vehicle prices that were $2,000-$3,000 higher than competitors.

Both issues are being addressed, he said, though some solutions will take time to materialize. A replacement for the Jeep Cherokee, which was discontinued last year and long filled the popular mid-size SUV segment, is coming and will include a hybrid variant, but won’t arrive before mid-2025. Ostermann stated that Stellantis is preparing for potentially higher tariffs under a future Donald Trump administration, given that the automaker produces about 40% of its products in Canada and Mexico. Trump has recently threatened 25% tariffs on goods imported from both countries.