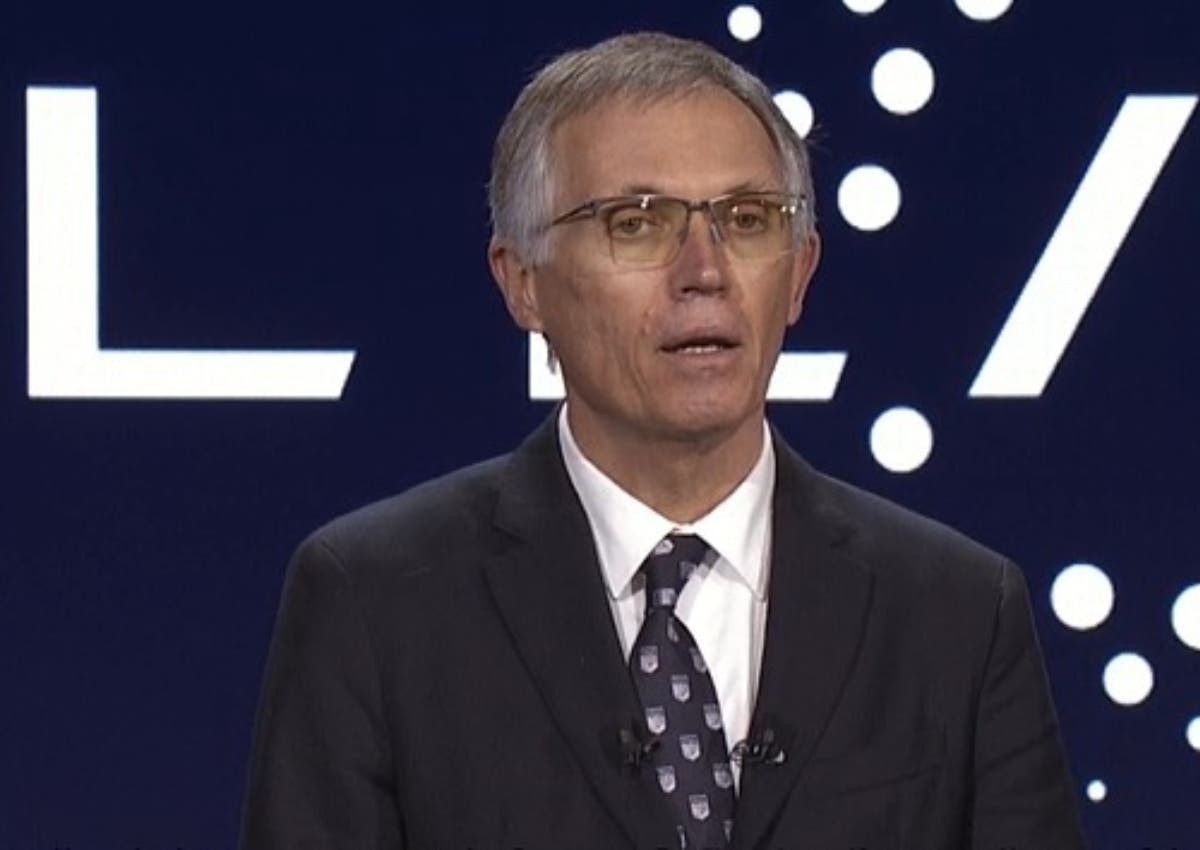

Carlos Tavares, CEO of Stellantis, during his visit to Sochaux, France, left the door open to possible cuts in dividends and share buybacks in 2025. The reason would be linked to problems in the U.S. market, currently struggling, after another quarter with disappointing sales, which recorded a 20% drop. The automotive group’s shares hit their lowest level since July 2022, and now shareholders fear that the costs of relaunching activities in the United States could jeopardize payments to shareholders.

Stellantis, Tavares says it’s too early for a 2025 plan: shareholders are worried

During the meeting, in addition to clarifying the possible merger with the Renault Group and his future as CEO of Stellantis, he also talked about operational difficulties in the United States: “When you are in a context which is brutal and more demanding, if you make a small operational error, well it is immediately visible,” Tavares said.

Shares of the company that owns brands such as Chrysler, Ram, Dodge, Jeep, and Fiat have plummeted by over 55% since March, recording the worst performance among European automakers’ stocks. As a result, the company’s valuation has decreased by $52 billion.

Kevin Thozet, a member of the investment committee at asset management firm Carmignac, stated: “This is a real blow to the investment thesis, as it could put the generous dividend at risk and will very likely imply saying ‘bye bye’ to buybacks,” Thozet said.

The main concern is about the difficult transition to electric cars. Stellantis has committed to paying the 2024 dividend, but Tavares said it’s still too early to confirm the 2025 plan: “It’s not yet time for the 2025 plan. We’ll see what happens at the end of 2024 and make a decision for next year,” Tavares stated. Meanwhile, Barclays has downgraded the stock from “overweight” to “equal-weight,” cutting its estimates.