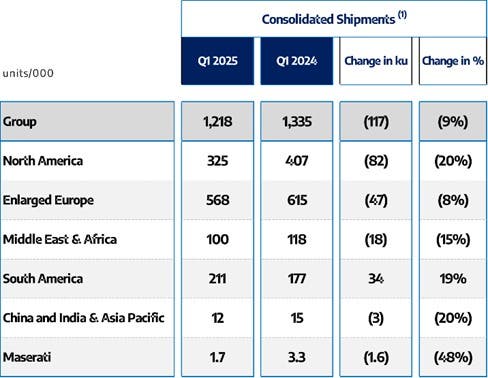

Consolidated shipments for the three months ended March 31, 2025 totaled approximately 1.2 million units

Stellantis: global shipments Q1 2025

Stellantis NV today released quarterly consolidated estimates of global shipments and provided comments on related business trends. The term “shipments” describes the volume of vehicles delivered to dealers, distributors or directly by the Company to retail and fleet customers, which determines revenue recognition.

Consolidated shipments for the three months ended March 31, 2025 amounted to about 1.2 million units, down 9 percent year-on-year mainly due to lower production in North America as a result of the extended January holiday downtime and in Wider Europe due to the impact of product transitions and lower light commercial vehicle (LCV) volumes.

Commercial progress in the first quarter of 2025 included the launch of all new and refurbished models, including the Citroën C3 Aircross, Opel Frontera, Fiat Grande Panda, Ram 2500 and 3500 heavy trucks, helping to generate positive momentum in order intake while maintaining normalized inventory levels at dealers.

New model launches and production challenges

The first quarter of 2025 was a period of intense commercial activity for Stellantis, marked by the market debut of a full range of new and significantly revamped models. This aggressive product strategy saw the launch of key vehicles such as the new Citroën C3 Aircross and Opel Frontera compact SUVs, the highly anticipated Fiat Grande Panda, and the powerful Ram 2500 and 3500 pickup trucks. These launches aim to revitalize the group’s offerings and capture consumer interest, generating a positive trend in new order intake.

Despite this promising business momentum, Stellantis experienced a 9 percent decline in consolidated global shipments to about 1.2 million units in the period ended March 31, 2025. This contraction is mainly attributable to two distinct factors:

In North America, a reduction in production was caused by an extended period of inactivity during the January holidays.

In Wider Europe, lower volumes were influenced by both transitions related to the introduction of new models (which can temporarily slow production) and lower demand in the light commercial vehicle (LCV) sector.

Despite these production challenges, Stellantis points out that new and refurbished model launches are contributing to an acceleration in order intake. In parallel, the group has maintained prudent inventory management at the dealer network, ensuring normalized inventory levels.

North America and Europe

In North America, first-quarter shipments decreased by about 82,000 units compared to the same period in 2024, a 20% year-on-year decline, mainly due to lower production in January, a result of the extended downtime for the holiday season, as well as the start of marketing of the new Ram 2025 heavy-duty vehicles. In terms of U.S. sales performance, Jeep Compass, Grand Cherokee, and Ram 1500/2500 volumes increased by more than 10 percent year-on-year in the first quarter of 2025. On an encouraging note, new retail orders in March reached the highest level since July 2023.

Deliveries in the enlarged Europe in the first quarter declined by about 47,000 units, down 8 percent year-on-year, two-thirds due to disruptions in the transition of some A- and B-segment vehicles to replace previous-generation products discontinued at the end of the first half of 2024, and one-third due to declining volumes of light commercial vehicles. Turning to sales performance in Europe, EU30 market share in the first quarter of 2025 stood at 17.3 percent, up 1.9 percentage points from the fourth quarter of 2024, partly reflecting the sales contribution of recent new product launches.

Within Stellantis’ “Third Engine,” shipments increased by 13,000 units overall, up 4 percent, driven mainly by a 19 percent increase in South America, which more than offset declines in shipments in the Middle East and Africa, China and India, and Asia-Pacific. Stellantis maintained its leadership in South America while benefiting from higher sales volumes, particularly in Brazil and Argentina. In the Middle East and Africa, the 15 percent drop in shipments was mainly due to the impact of import restrictions in Algeria, Tunisia and Egypt.