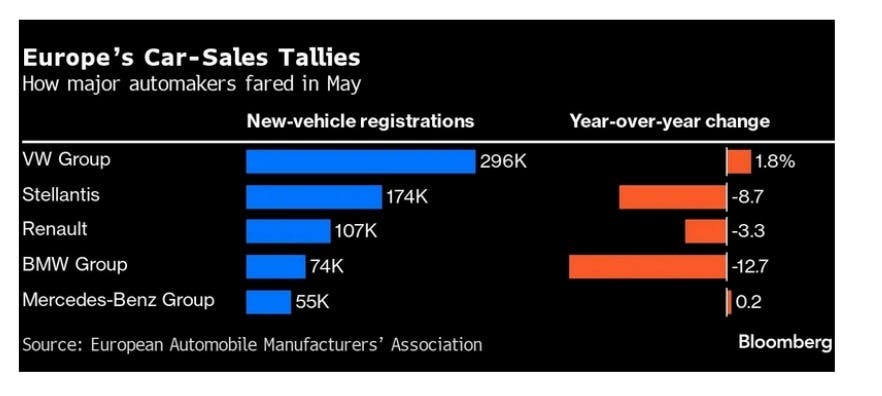

Stellantis archives a bad May 2024 in Europe, after an equally difficult April 2024 in the Old Continent. Registrations in the area composed of the EU, EFTA countries, and the United Kingdom amount to 1,092,901, which is 2.6% less than the same month in 2023. Among the automotive groups, Volkswagen remains the leader with 296,446 registrations, an increase of 1.8% (Cupra +14.6%, Audi -10.1%, and the luxury division Bentley plus Lamborghini -12.8%). Stellantis registered 173,969 cars, down 8.7%. In detail, Peugeot -13.2%, Opel/Vauxhall -7.8%, Fiat -12.6%, Alfa Romeo -14.4%, Lancia -18.4%, DS -42.4%, and Maserati, Dodge, and Ram -25.4%. Citroën (+7.6%) and Jeep (+2%) are the exceptions. In third place among automotive groups is Renault with 106,570 units (-3.3%).

Stellantis: sales in Europe also fall in May 2024

The myth of the electric car that would have succeeded in Europe is shattered against the harsh reality of facts. BEVs fell by 11% with -30% in Germany and -18.3% in Italy. The market share of electric cars drops from 13.8% in May 2023 to 12.5% in May 2024. There are plug-in hybrids, often grouped together with electric cars to inflate the latter’s data: -9.6% in Europe.

High prices have become one of the main obstacles to the growth of electric vehicles in Europe. Volkswagen, Stellantis, and Renault are preparing cheaper models of around 25,000 euros ($26,865), but they will arrive in 2025. Several manufacturers are adjusting their targets for electric vehicles, with Stellantis and Mercedes suspending work on two electric vehicle battery plants in Germany and Italy. VW is focusing on plug-in hybrids, while Mercedes itself expects to sell combustion engine cars longer than expected. Normal hybrids, the non-electrified ones, are saving the sector with +15.4%.